Gross up formula

Affordable Up to 50 less than a traditional payroll service. Gross-up 765 1 3565 765 6435 If you multiply the gross-up with the marginal tax rate as a percentage 42381 is the tax amount.

What Is Gross Up Tax Gross Up Formula Definition Caprelo

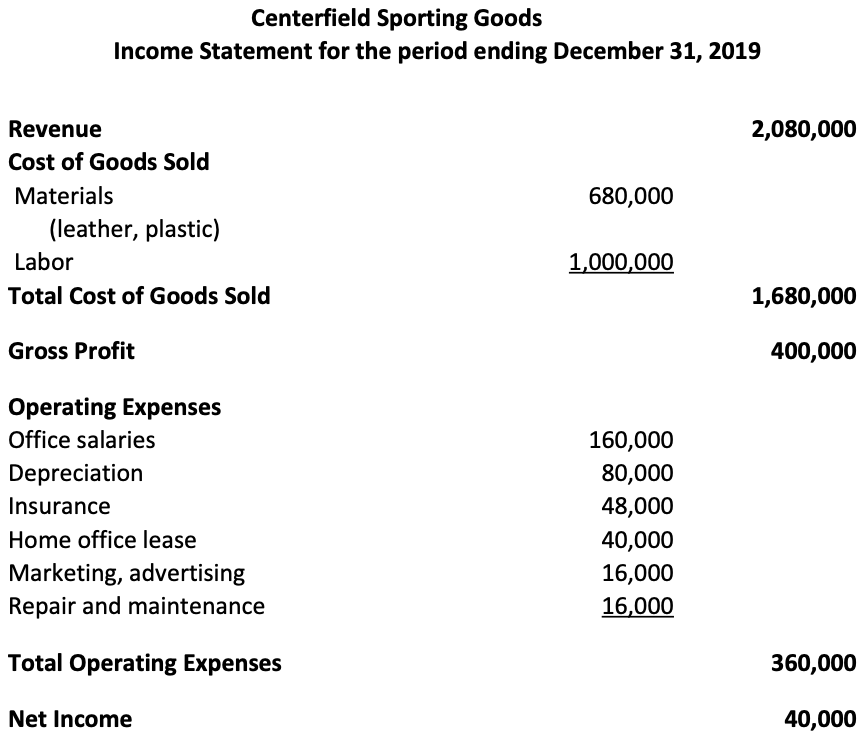

Calculate the Tax Rate.

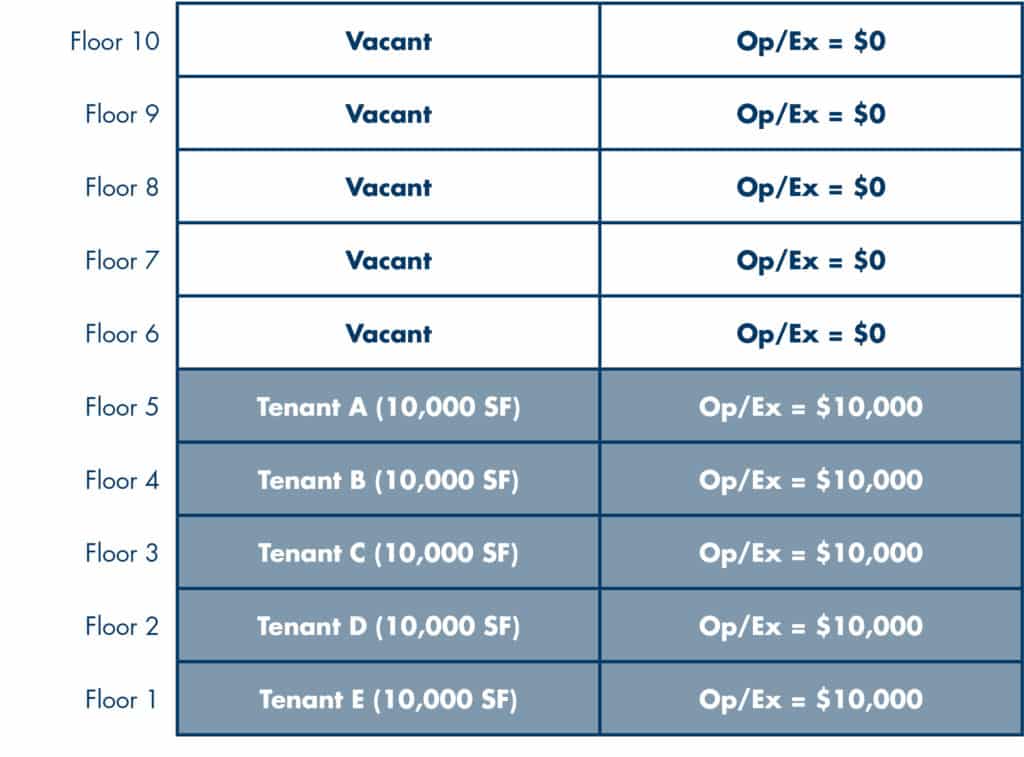

. Its not a simple 122 increase which would equal gross 12200. Expense Gross Upsor Grossing Up is a term that frequently appears in commercial real estate leases. Cant use the normal grossing up.

3 Tax Gross-Up Formulas Examples Formula 1 The Flat Method. Gross pay net pay 1 tax rate. At what occupancy the gross-up provision can be.

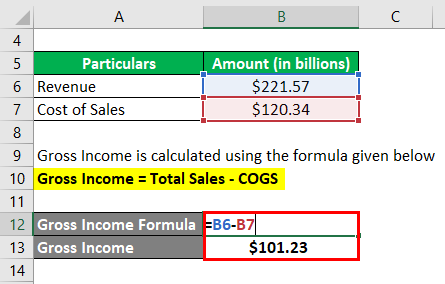

Trying to figure out how to calculate the required gross amount for a financial distribution when I know the net amount and individual taxes. This will give you the net percent. Use this federal gross pay calculator to gross up wages based on net pay.

Gross Up Amount. Gross Up Calculation Examples A department may choose to pay the federal withholding tax for a foreign national however the amount paid in tax. Divide the net wages by the net percentage.

If you want to experiment with our gross-up calculator you can calculate gross pay based upon take-home. Gross pay net pay 1 - tax rateHow do you calculate gross-up netDivide desired net by the net tax. Calculate your gross wages prior to the withholding of taxes and deductions.

Because when you take a gross distribution of 12200 with 22 2684 for taxes you get a net distribution. 1 Total Taxes Net Percent. The two points of negotiation are.

Grossed-Up 338 h 10 Adjustments has the meaning specified in Section 412 d iv. Grossing Up is a process for calculating a tenants share of a. This is why the calculation is to DIVIDE BY 1.

This is an estimated amount that the department needs to pay that will show on the employees check before withholdings. Net interest 100 divided by 1-020 080 The tax is charged on the gross amount of 125 x 20 25 tax. Or Select a state.

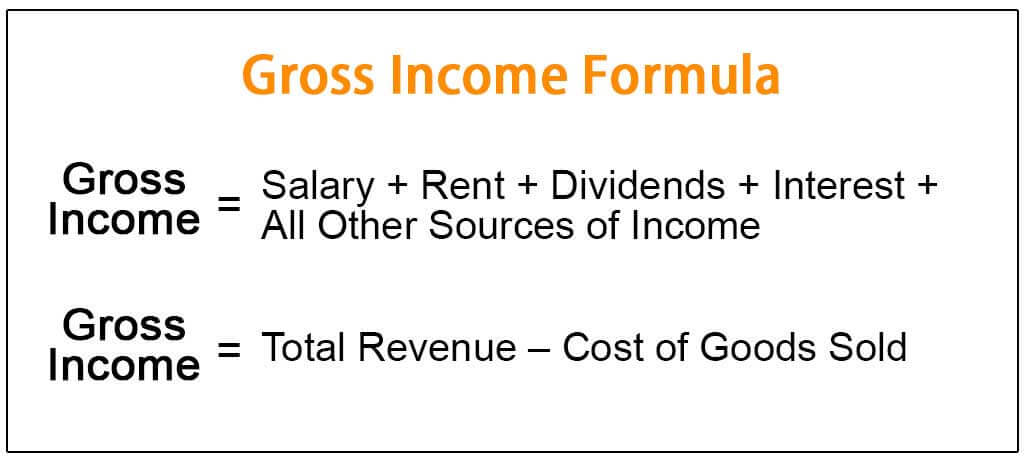

Below are four basic steps employers should take when grossing up salaries. Youll just need a few things including your net or take-home pay amount. The formula used to calculate a gross-up is.

Gross-Up Formula has the meaning specified in Section 412 d iv. What is the gross-up formulaThe formula for grossing up is as follows. If you subtract the tax amount.

Then take the total tax rate as a decimal and subtract it from 1. The flat method uses a flat percentage calculated on the taxable expenses and then added to the. For example if an employee receives 500 in take-home pay this calculator can be used to.

As a result Janes gross. You work backward to come up with the gross-to-net pay calculation and divide 5000 by 75. To remedy the situation you can gross up Janes bonus check.

Using the gross-up formula below the total. The terms of a gross-up provision can and should be negotiated and outlined in your lease.

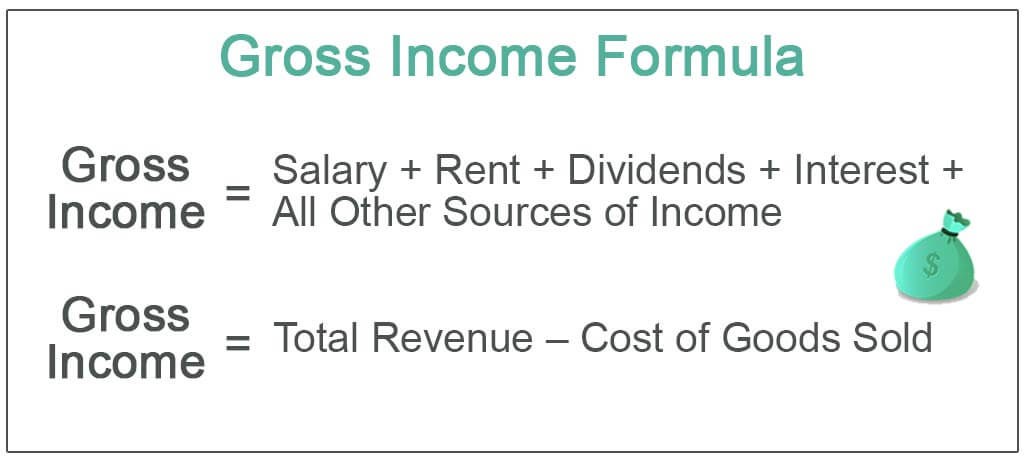

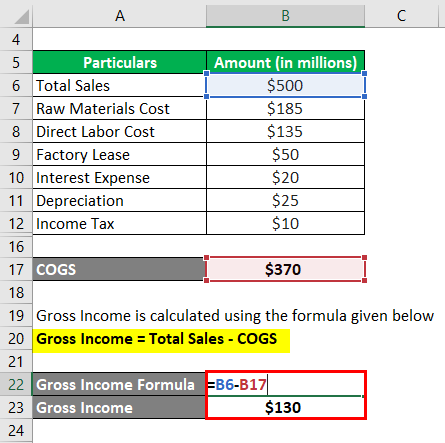

Gross Income Formula Calculator Examples With Excel Template

Guide To Gross Income Vs Net Income

Gross Income Formula Step By Step Calculations

What Is Gross Margin And How To Calculate It Article

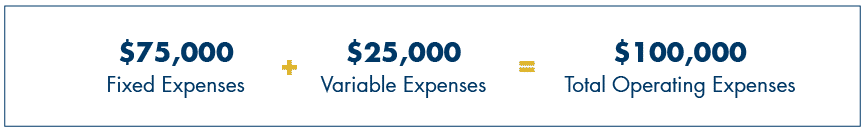

What Is An Operating Expense Gross Up Provision In A Lease

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Income Formula Calculator Examples With Excel Template

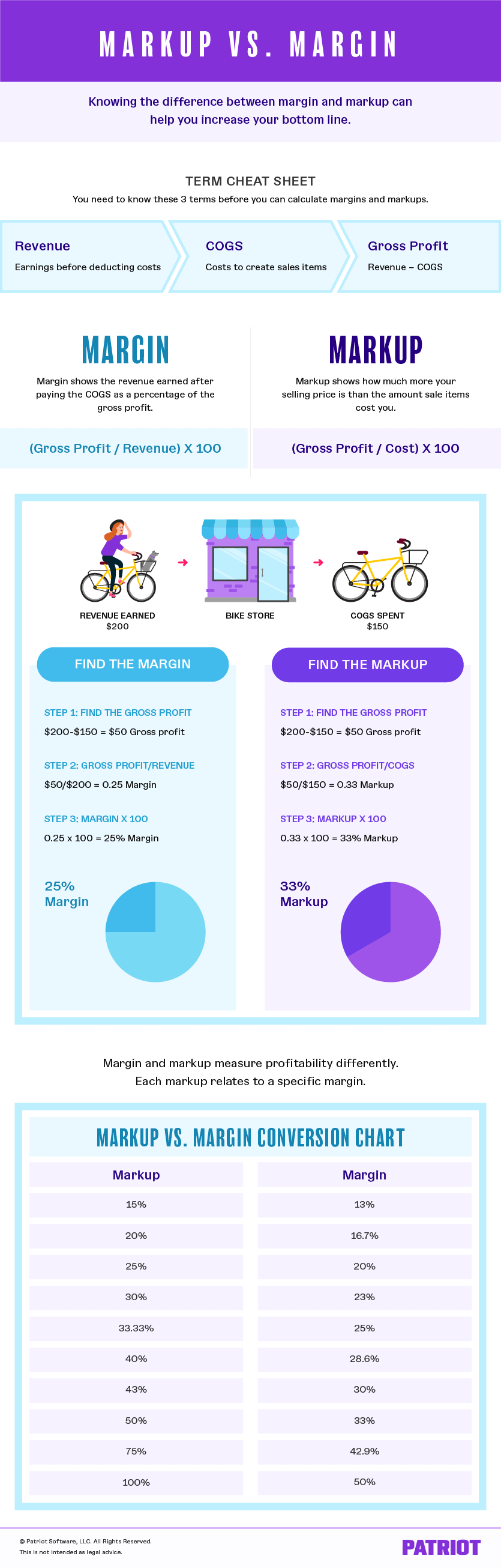

Margin Vs Markup Chart Infographic Calculations Beyond

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

What Is An Operating Expense Gross Up Provision In A Lease

Gross Profit Margin Formula And Calculator

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

How To Calculate Gross Income Per Month

Gross Income Formula Calculator Examples With Excel Template

Net To Gross Calculator